A Short Guide to Memecoins in 2024

None of this is financial advice and all the information is provided for entertainment purposes only. I'm not a crypto guru, just sharing my findings and opinions.

The crypto market has been booming lately with a ton of money being injected into memecoins specifically.

Memecoins have outperformed nearly every other sector this cycle, even Bitcoin. For younger generations locked out of traditional investments like real estate or blue-chip stocks, crypto—especially memecoins—offers a shot at massive gains. But it’s not all sunshine and profits. To succeed, you need to dodge the traps. If you’ve been wondering how to go about buying memecoins, or if you've been losing money on memecoins left and right, let me share some hard-earned tips to possibly help turn things around.

But first, let's devide memes into categories according to their size.

In the context of meme coins, the market cap categories are often skewed compared to traditional cryptocurrencies because memes tend to have much smaller market caps on average. Here's a rough breakdown:

-

Microcap Memes (< $1 million): Very small, high-risk, high-reward plays that can move fast, and liquidity is often limited.

-

Low-cap Memes ($1 million - $20 million): Still highly volatile but with more community backing. These coins are slightly more established but remain very speculative.

-

Mid-cap Memes ($20 million - $100 million): A $20 million market cap is likely a mid-cap meme coin, indicating a decent amount of community traction and some level of sustainability. Growth potential is still strong, but it's not as risky as smaller caps.

-

High-cap Memes (> $100 million): Think Dogecoin or Shiba Inu levels. These coins often become blue-chip meme coins, with large, loyal communities and a level of stability relative to smaller meme projects.

Memecoins to Avoid

New Launches on Pump.fun

Anyone can launch a token on Pump.fun, making most of them scams. It’s like buying a shady lottery ticket. Research published by Chainplay shows:

- 98% of memecoins on Pump.fun fail within 3 months.

- 10,417 tokens launch daily; 9,912 die the same day.

- Average lifespan? Just 12 days.

Compare that to the average memecoin lifespan outside Pump.fun (1 year) or non-meme crypto projects (3 years), and the risks are clear.

This research was done like a month ago, so this is likely even more now that BTC has been soaring bringing more bullishness into the market.

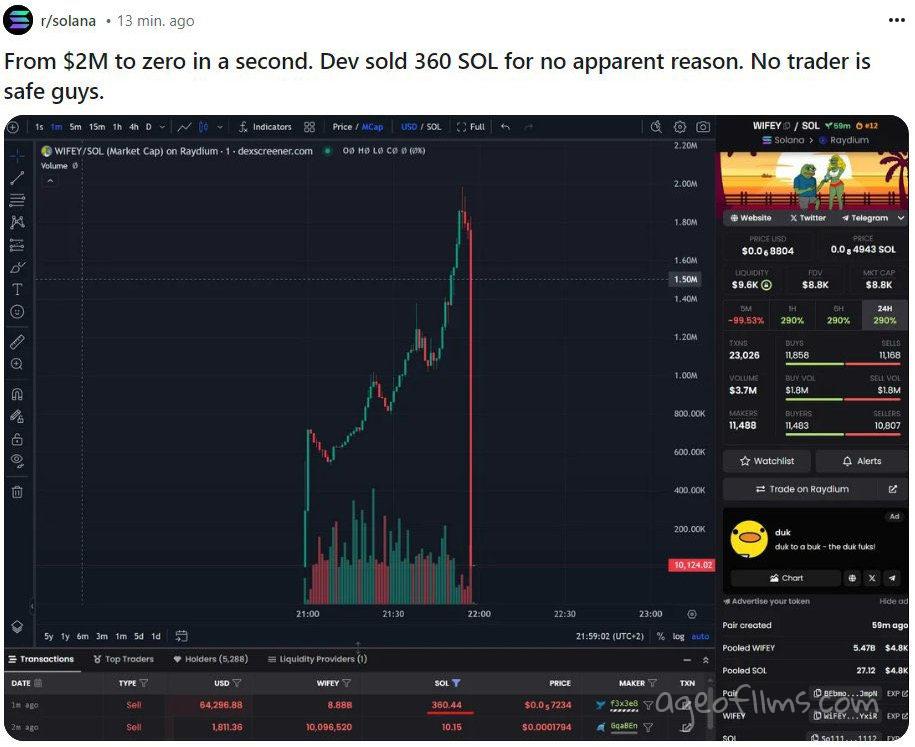

So scammers often launch these pumpfun coins while holding 50–70% of the supply. And just as as you’re almost celebrating a 100% gain, they’re cashing out with 6000%. These dumps can wipe out 70% of a token’s value in minutes, and sometimes in a matter of seconds:

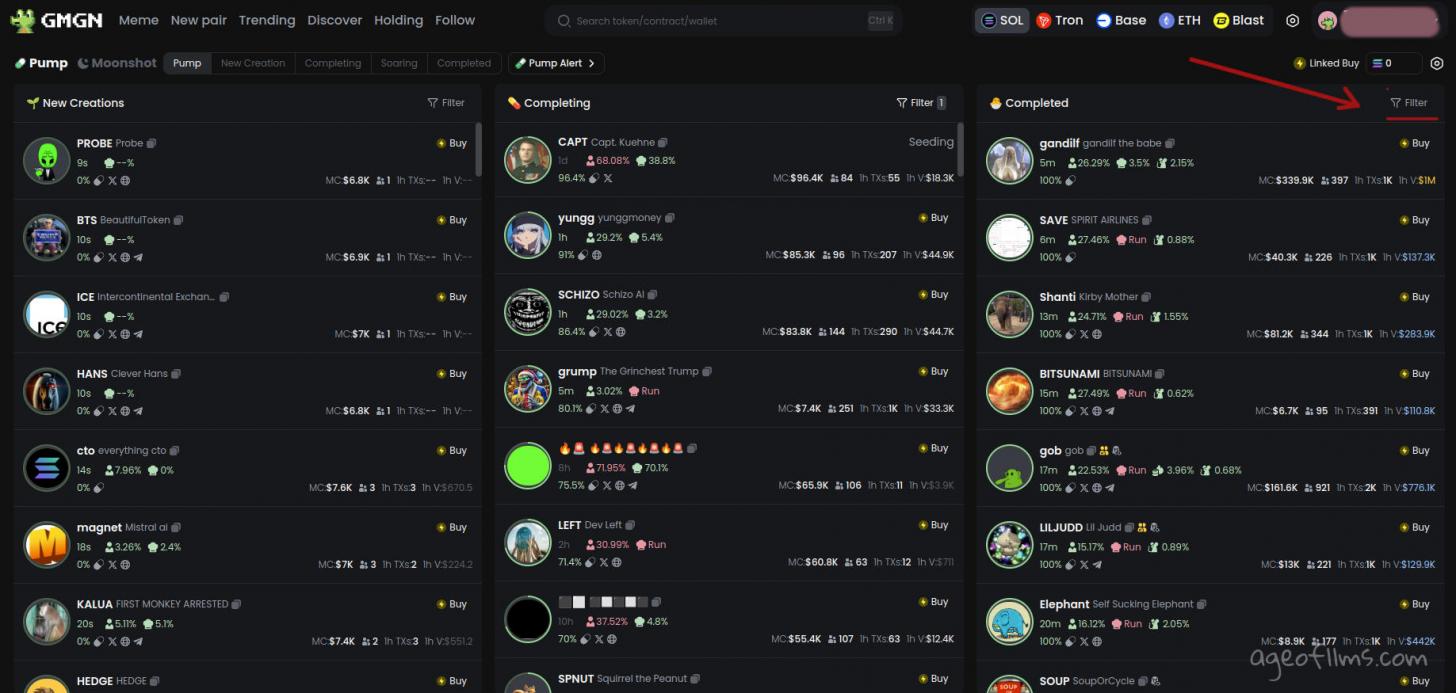

If you still want to try your luck on Pump.fun, tools like GMGN can help. They show real-time data on new tokens, volume, and dev activity.

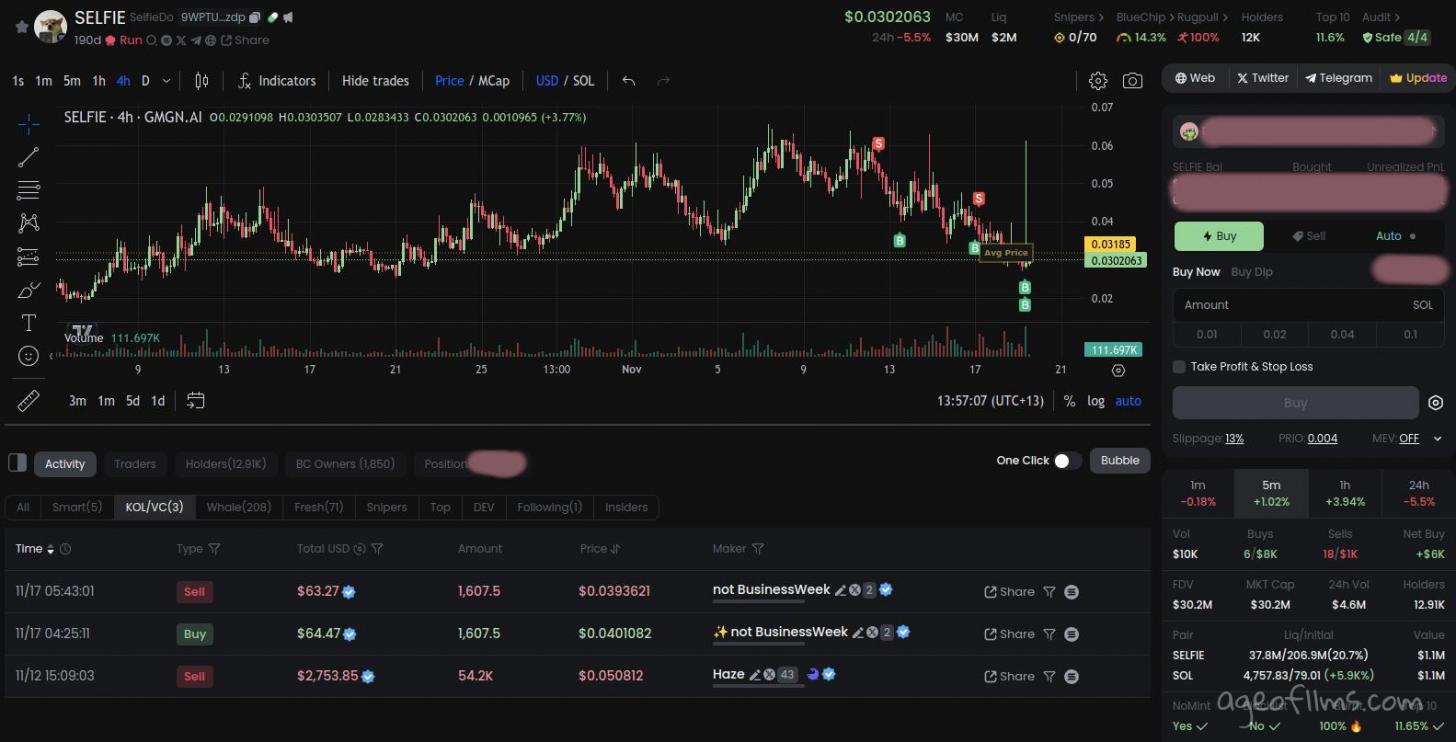

It also provides a handy interface to trade tokens, right from the page with all the data:

And helps you keep track of youe average buy price, so you know every second whether you're in profit and what percentage.

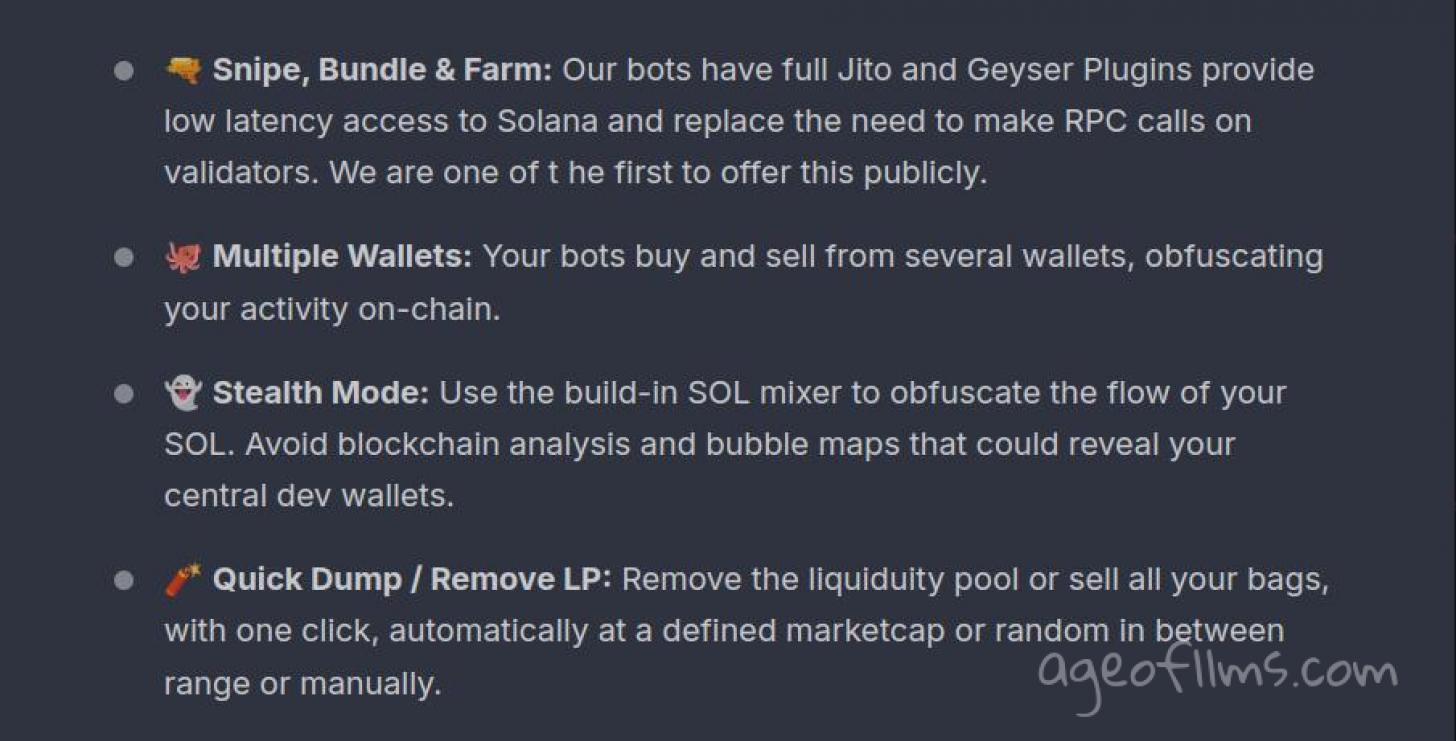

But remember—scammers have even better tools than you.

They use software like Pumpfarmer to manipulate markets and avoid detection.

Cabal (VC-Backed) Memecoins

At first glance, VC-backed coins seem promising. They hit massive market caps quickly and attract lots of attention. But they’re usually a losing game for retail traders. VCs sell tokens to fund operations, pay influencers, and secure profits, leaving regular buyers as their exit liquidity.

When it comes to VC-backed memecoins, the odds are stacked against regular traders. These tokens might grab attention early, but they’re usually designed to enrich the few at the expense of everyone else.

Why VC Coins Fail Retail Traders

- Harder to Pump Over Time: Once the initial hype fades, these coins become nearly impossible to pump. Their thick liquidity (funded by VCs) drags down price momentum, especially as prices fall.

- Slow Rugs: After a few days of activity, the project becomes a slow rug—steadily bleeding value while unsuspecting holders cling to false hope.

- Lack of Memes or Community: VC coins often come with weak memes and no organic community. Without believers rallying behind them, they fizzle out fast.

Designed for the Rich to Get Richer

VCs and their inner circle dominate the early stages of these tokens. Their playbook?

- Seed heavy liquidity pools and offer "cheap entry" to influencers (KOLs) who can hype the coin.

- Dump their holdings once retail money pours in.

- Exit quietly, leaving retail traders holding worthless tokens.

These coins aren’t about creating wealth for you—they’re about multiplying the wealth of those who already have it.

KOL Pump-and-Dumps

KOLs (Key Opinion Leaders) are influencers who often buy in early, hype a token, and sell at a profit once their followers start buying. These coins rarely last because the hype fades quickly as KOLs dump their allocations on their followers and stop talking about that coin. Without a solid community or long-term vision, they fizzle out after the initial pump.

Where to Focus: Organic Memecoins

If Pump.fun and influencer-backed tokens are the Wild West, organic memecoins are the hidden gems. These projects thrive because of strong communities, not marketing hype.

Take WIF and Popcat as examples. Both started as scams but were later reclaimed by passionate groups. These “Community Takeovers” (CTOs) show the power of belief and collaboration.

When a project has a dedicated following, it can weather market downturns and even bounce back stronger after big dumps. While these tokens may not offer the tiny market caps of fresh launches, they’re a much safer bet for long-term gains.

Spotting the Good Ones

1. Pick Mid to High Caps, Dabble in Small Caps

Filter memes by market cap size and stick to those with at least 5 Million MCap. The larger the safer, adjust according to your risk tolerance. I'd still dabble in small caps near $5 million for a bit of excitement, especially if they've been around longer than say 1.5 - 2 months. Whether you're looking on Coingecko or CoinmarketCap there's a filter ad sorting option by this parameter. Coingecko seems to have a particularly large selection of memes.

2. A Strong Community

Great memes are powered by passionate communities. The meme itself—a catchy image or phrase—is just the starting point. What matters is how the community builds a culture around it.

Look for:

- Consistent leadership: Do community leaders show up daily? Are they rallying others to contribute?

- Maximalist attitudes: Do members genuinely believe in the token’s mission, or are they just chasing quick profits?

One good way to check that is to go on Twitter (X) and search the ticker. Gauge the engagement, the activity, the buzz.

3. Holder Count Trends

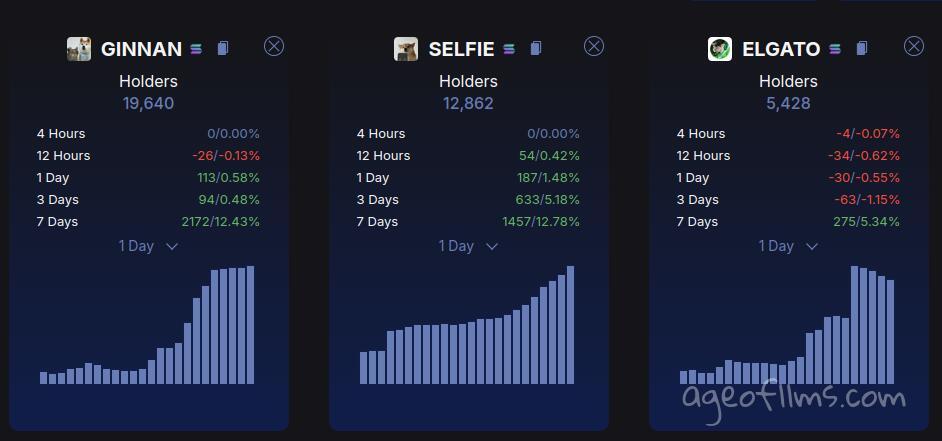

Use tools like HolderScan to monitor how a token’s holder count is changing.

- A rising holder count suggests growing interest and stability.

- A declining count is a warning sign.

- A plateau is neutral but could signal consolidation before growth.

4. Memeability

Meme coins with fun or relatable themes (like humor or culture) often build stronger, more loyal communities.

Go for memes with broad appeal—the easier it is for people to get the joke, the better its chances of going viral. Careful with memes that pump due to novel but more obscure narrative, they can be short-lived once the novelty wears off.

How to Trade Memecoins

- Only Play with What You Can Loose: Never gamble the amount of money you can't afford to say good bye too. Even when you're sure-sure it's a winning bet, do not take on debt or buy with your children's milk money. This market is wild and can crash any moment without recovering.

- Entry Timing: Avoid buying during big green candles, as they often signal the peak of hype. Wait for pullbacks near support levels. While traditional technical analysis doesn’t always apply to memes, basic principles of supply and demand often hold.

- Take Profits:

Always lock in gains. Here’s a simple strategy:

At 2x, pull out your initial investment.

At 3x, sell 25–50% of your remaining holdings.

This protects you from sudden dumps while still keeping upside potential. - Avoid FOMO: Missed a trade? Let it go. FOMO-driven plays often lead to bigger losses. Notice how this market keeps producing new 'gems' all the time, non stop. If you must, buy a tiny amount at the top to satisfy that urge. If it goes up, you can win something, but if it crashes down 70% you won't lose as much.

- Be Wary of KOLs and Paid Groups: Influencers often dump coins after hyping them, and paid “alpha” groups rarely deliver consistent wins. If someone claims to make 10x gains daily, ask why they need your 3 SOL subscription fee. You will see guys posting pictures with PNLs in the thousands of percent, especially showing smth like 1 SOL turned 100 SOL in a matter of hours. But once you're in, you'll likely find that you're also fed many more losing calls, only those aren't advertised, in fact, they may be deleted from the feed to make it look like they're getting every play right. I've once followed a wallet of a guy who've joined one such group. And well, his luck hasn't changed much since.

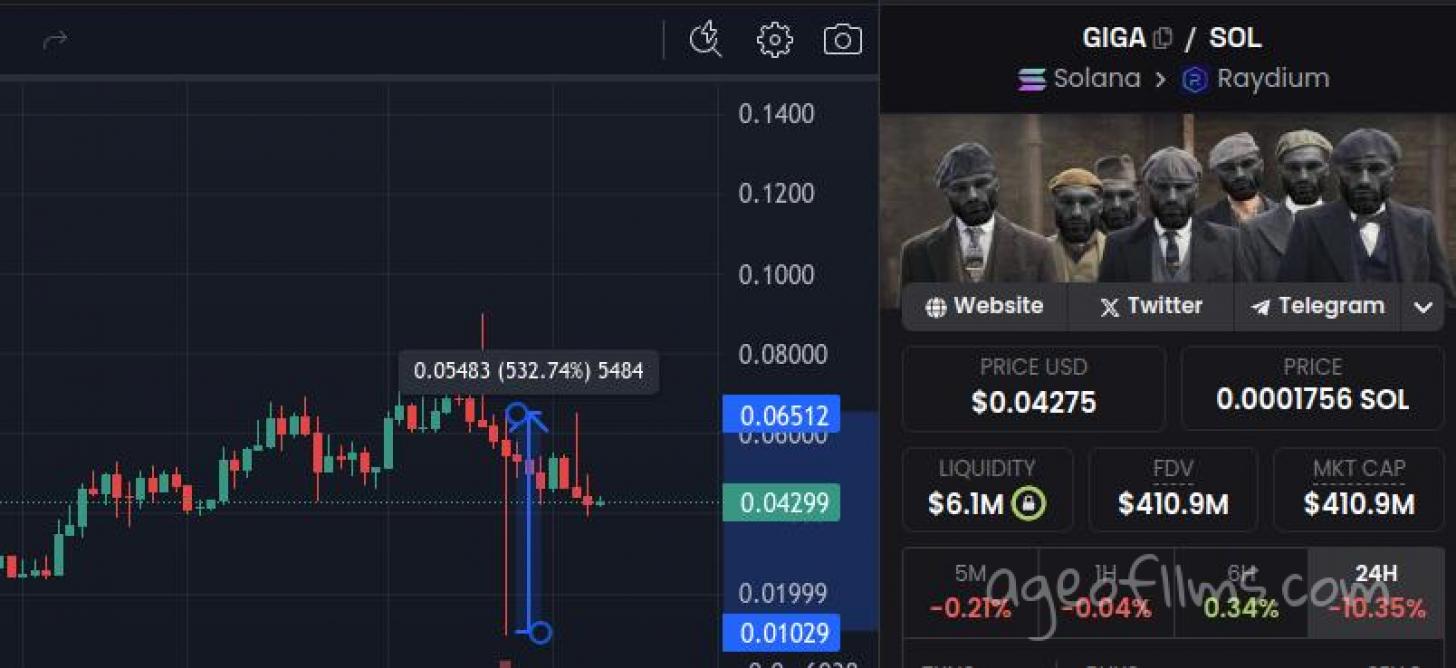

- Buy the Dip! (Sometimes): There could be different reasons for the dip or even a dump (large sharp correction). Sometimes it's even wise to sell soon after the price crash if it's unlikely to ever go up again, like for example a coin's whole point of existence is undermined, if it had claimed to be something it's actually not and that is now being revealed. But sometimes a sell off occurs because a whale decides to cash out. because he's just had enough for the time being. Just like smaller players, big players like to take profits. It doesn't necessarily mean the token is bad, because whales don't hold forever, or they wouldn't make any money. They also like to protect their investments, take out initials etc. A huge sudden dip - at the absolute bottom of it - is usually a good buy for at least a quick 20-30% up recovery, but after that a long boring consolidation usually ensues, unless it's a mega popular coin like GIGA:

GIGA recovered from crash bringing quick 500% to dip buyers - Diversify. Spread your bets between a few coins instead of going all in on one. Chances of them all dumping at the same time are smaller, providing you a bit more security.

All the above are basic rules which work most of the times, but on some occasion the opposite will happen: you'll see a token you thought was good, backed by scammiest of KOLs pump to unimaginable heights from the point you couldve bought but resisted the FOMO. There is no avoiding that sometimes, but you're still better off consistently protecting your capital because if you won't - you won't have capital to trade with any more.

Do not keep pouring money into crypto endlessly, as if your luck is about to change if you just keep trading just a bit longer. If you can't turn 30 bucks into 60, then into 90 and into 180 consistently - you will just as easily lose larger sums of money. If you really 'got it', 'figured out the game', then it should be no problem for you to recover from losses with the existing capital. What I'm saying is, don't become a gambling addict, it's a real thing and it's very destructive.

Final Thoughts

Memecoins are extremely risky, but the best ones will outlast the hype and bring massive gains when the market rebounds. Focus on strong communities, and remember—it’s smarter to bet on proven winners than gamble on untested tokens. Allocate only what you can afford to lose, and treat high-risk plays like trips to the casino.

Crypto likely won’t solve your immediate problems, and it’s not a reliable way to make a living unless you already have substantial capital + crypto trading experience. Forget the dream of instant riches. You won’t turn $100 into $100K overnight, even if you’ve got debts or bills due tomorrow.

Don’t rely solely on crypto. Trading under financial pressure—when you’re worried about food or rent—will only lead to bad decisions. Instead, think of crypto as your “secret side project.” It’s a skill you’re quietly developing behind the scenes, a craft you’re mastering while staying focused on stable income sources.

Enjoy the bull run, and trade smart!

Published: Nov 19, 2024 at 5:10 PM